After months of development and testing, your mobile app or game is finally ready for a global launch. Now, the critical decision looms: which markets to focus on and where to strategically invest your user acquisition budget. Making the right choice isn’t easy and involves a multitude of factors, especially in the highly competitive mobile gaming industry.

I recently helped Geewa, a leading online and mobile games company based in Prague, pick target countries for its game called “Pool Live Tour 2”. Our process was rigorous and data-driven, providing valuable insights applicable to any mobile app or game publisher.

Here are our key learnings from building that decision-making process for mobile game market selection:

1) Leverage existing game performance data

If you’re working on a sequel or have other games in your portfolio, you should use the ARPDAU (Average Revenue Per Daily Active User) and LTV (Lifetime Value) of your previous game as a baseline. Work with an average of several months and filter out data where you have a small DAU average. This helps you avoid statistical errors based on a few “whales” who might skew the typical monetization behavior in a small dataset. For a deeper dive into LTV, read our guide on Growing subscription-based mobile apps with LTV prediction or download our Retention to LTV Calculator / Predictor.

2) Analyze cost per install (CPI)

Having a large data set from a previous user acquisition campaign is a significant benefit. If you’re starting from zero – as we did with Pool Live Tour 2 – you can use sources like Chartboost CPI data to compare the price of user acquisition per country. Our findings from several campaigns show that we were able to get the average down to 60% of the Chartboost index price. We primarily used Facebook ads to reach users because it offers precise targeting options for mobile game players. Understanding your Customer Acquisition Cost (CAC), which is closely related to CPI, is vital for profitability. Learn more in our blog post, How to Calculate Customer Acquisition Cost (CAC) for Mobile Apps.

3) Understand market potential data

Tools like Priori Data, including its free-of-charge option, provide invaluable understanding about app downloads and revenues per category. This is particularly interesting if you create a “purchase ratio” (revenue divided by downloads). You will immediately see that several markets are downloading games in your category (e.g., strategy, sports, puzzle) like crazy but are not willing to spend money.

Avoid those! Focus on markets where users demonstrate a willingness to monetize within your specific app genre.

4) Benchmarking against competition

You surely have a number of competitors in the mobile app or game space. Use business intelligence tools – such as those offered by Priori Data – to get estimates of their downloads and revenues per country. Look at the purchase ratio again and compare revenue to the estimated CPI in promising markets to get a clearer idea of the true user acquisition costs.

Sometimes, it’s better to focus on not-so-obvious markets, which may allow installs for a fraction of the price compared to the Tier 1 regions. Another strategic approach might be to avoid smaller markets where your competitor has already had huge success and established dominance. For more on competitive analysis in user acquisition, consider our insights on mobile intelligence tools every marketer should know.

5) The top 10 chart challenge

If you plan to reach top app store charts, then you should accurately account for what it takes in terms of downloads and sustained engagement. There might be a world of difference between getting into the Top 10 on iOS in the US and, say, Denmark, which is a smaller but often very well monetizing market. The organic uplift from hitting top charts might be in the tens of percent, but it’s prudent to get real data on a smaller, more manageable market before you aim for bigger ones (and potentially burn a lot of money doing it).

6) Assess audience size and niche fit

If you have a “niche” game (like a cue game, as in our example) or are targeting specific players (e.g., board game fans or manga fans), then you can use platforms like Facebook to find out the specific audience size per country using their Ads Manager. Facebook gave us great insights on what we should focus on, outside the traditional large markets such as the U.S. or the UK, uncovering hidden opportunities for mobile game user acquisition.

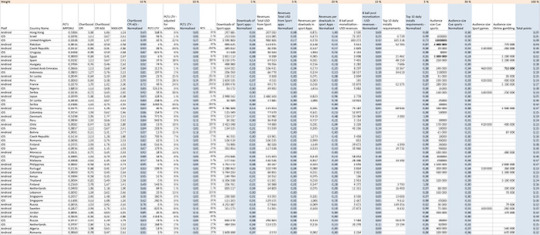

7) Making smart use of data for final selection

We normalized the above factors for leaders on each platform to get several ‘indexes’ per country. Later, we set weights for each of our six factors and calculated a total score. Once we put them in a descending order, we saw a prioritized list of most promising countries and made our final target market decisions after a comprehensive discussion.

At this final stage, it is important to consider local specifics. Some countries might require a ‘localization’ of the game as its users may prefer a particular game genre (in our case it was a specific sport genre) or games might not be to the liking of local culture at all (typical for Asian markets). Conducting local research and having an insider from the regions such as MENA or Asia is crucial before making the final selection.

What is your strategy for picking markets for your apps or games? Do you use data sources not mentioned in this post? Don’t hesitate to share your thoughts and experience with others in the comments section below.

Our massive spreadsheet filled with (sorry, but blurred) data.

PS: Thanks for a cooperation to my team mates at Geewa – Tomas Hnilicka (CFO) and Martin Brykner (Marketing). They both contributed with great ideas and picking best countries was a true team work!