The goal of this article is to dissect Venmo’s growth strategy brick by brick and suggest how you can apply it to your business model.

Venmo is a popular finance app, particularly used in the United States, that simplifies sending, receiving, and splitting money between friends and for business transactions.

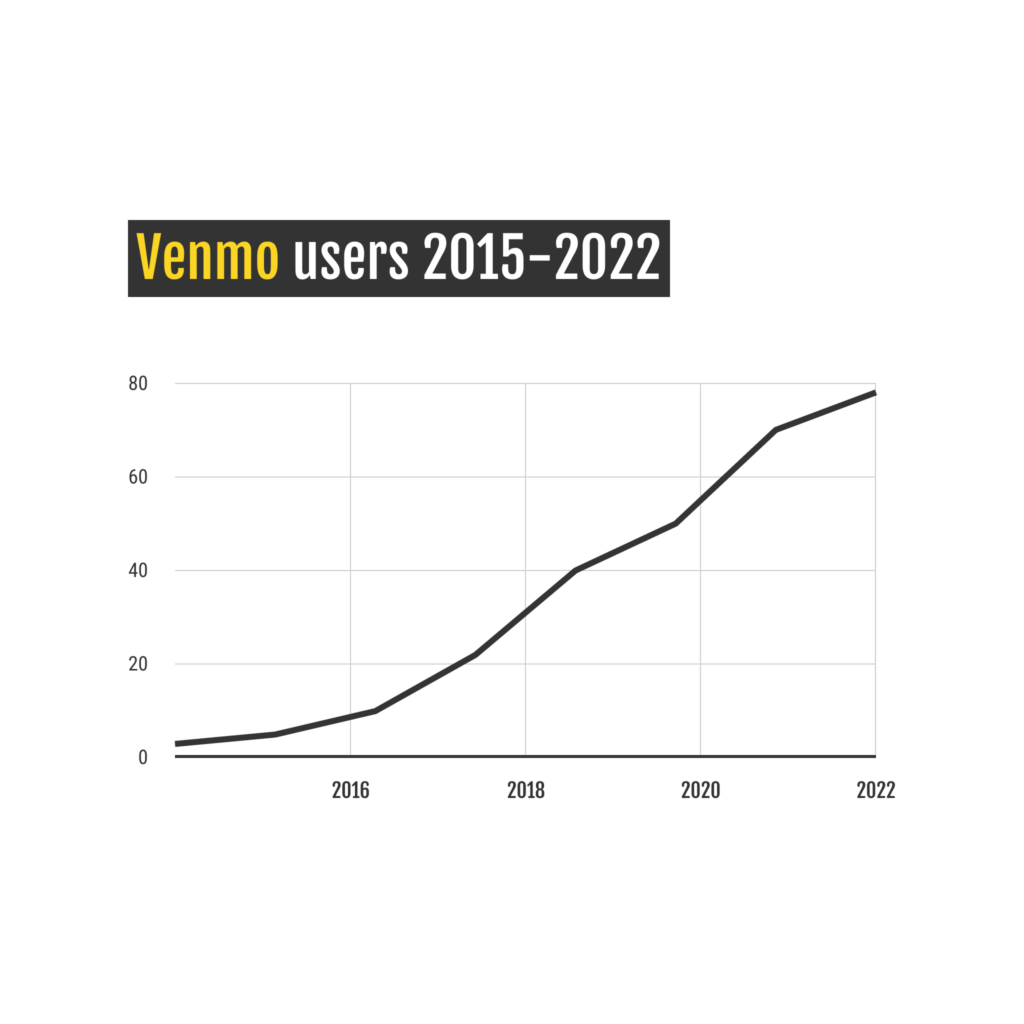

In 2015, PayPal announced that it had acquired Venmo for $800 million, and it retains ownership of the app to this day. By 2022, Venmo proved its financial prowess with a staggering $244 billion in total payments and estimated earnings of $935 million with over 78 million users (source).

The State of the Digital Payment Market

The COVID-19 pandemic accelerated the global adoption of digital payments, including in the United States.

In 2021, more than 40% of US smartphone users experimented with contactless payments, resulting in a remarkable 69% increase in adoption by retailers.

Looking ahead, Insider Intelligence’s projections indicate that by 2025, approximately 50.1% of smartphone users will be making in-store purchases using digital payment methods.

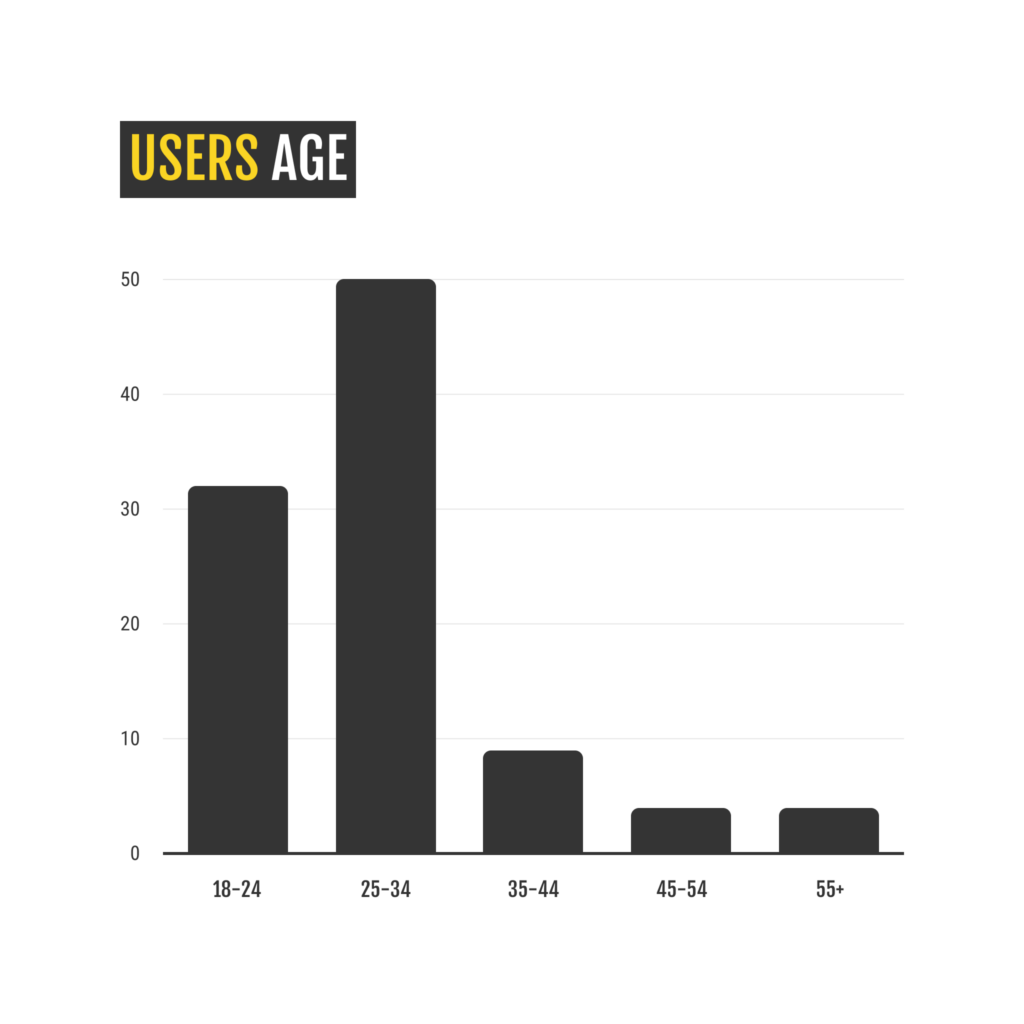

Younger consumers, notably Gen Z and millennials, who constitute the core user base of Venmo, have been the most enthusiastic participants in this evolving payment landscape.

Venmo's Competition on the Market

In 2017, the seven largest banks in the US launched Zelle, a direct competitor to Venmo (but which lacked the social aspect).

Square’s Cash App is also a strong competitor in this market, and it achieved notable success in 2020 by introducing Bitcoin and investment services.

In 2021, Venmo had a user base of 77.8 million people, which accounts for nearly 30% of the entire US population. And it is expected to continue growing and surpass 100 million users by the end of 2024.

In the realm of peer-to-peer (P2P) mobile payments, Venmo stands out as a dominant player, with almost 58% of US P2P mobile payment users.

Venmo's Growth Strategy

Now that we’ve got a grasp on just how massive Venmo’s growth has been, let’s take a deeper look into the strategies the company employs to maintain this impressive trajectory.

Perfect fit with its Core Audience

The younger generation, Gen Z, is rapidly adopting mobile P2P payments. Venmo has seamlessly integrated into everyday lingo, much like Google and Uber. It’s now common for people to casually say, ‘Just Venmo me’ when dividing expenses.

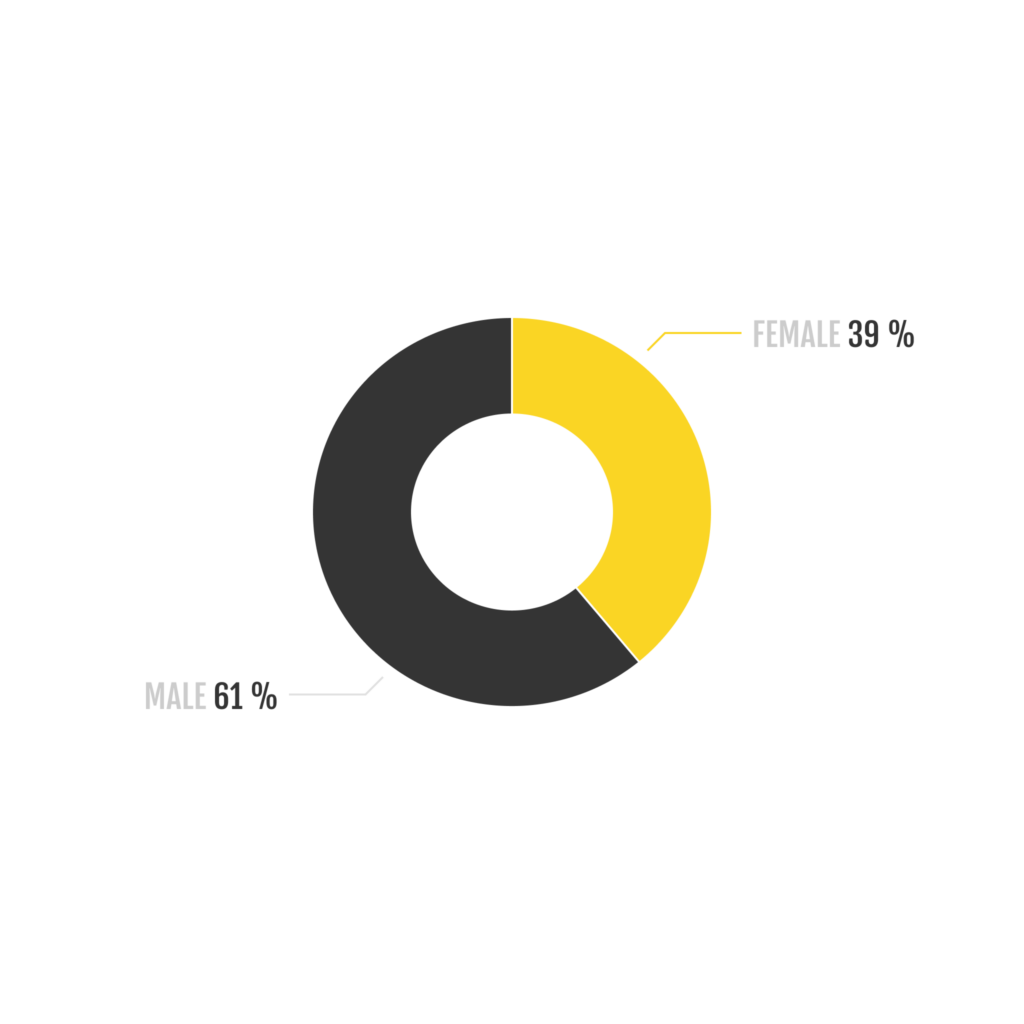

According to Business of Apps, Venmo’s primary target audience consists of Gen Z and Millennials, with a demographic split of 61% male and 39% female.

There are several characteristic traits commonly associated with Gen Z (source), including:

- Strong Brand Loyalty: Gen Z tends to form strong connections and loyalty to the brands they use.

- Active Engagement: Approximately 43% of Gen Z individuals are eager to participate in product reviews, showcasing their active engagement with trusted brands.

- Short Attention Span: With an attention span typically lasting less than 8 seconds, this attribute becomes especially poignant for a generation raised on platforms such as YouTube and deeply influenced by the short-form content prevalent on apps like TikTok.

- Perceptiveness to Omnichannel Marketing: An impressive 88% of Gen Z individuals prefer omnichannel marketing. This underscores the importance of engaging with them across multiple platforms, including social media, YouTube, and mobile devices.

Has Venmo effectively utilized this understanding of its target audience? Absolutely, so let’s explore how they’ve done so.

Strong social Element

Venmo’s social aspect remains a central feature: at the heart of the entire experience lies the “newsfeed”. This feed allows users to browse updates that let others know about their financial transactions and who they’re with.

According to PayPal CEO Dan Schulman, “Venmo users open the app four or five times a week. But they only do transactions a couple of times a week,” he said. “It’s because everyone is looking at the feed to see, ‘What did you buy?’ ‘What icons did you put on your feed?’ ‘Why did you go and buy that?’

Venmo keeps things engaging through three distinct feed options: worldwide, friends-only, and personal. The worldwide feed showcases all financial transactions, the friends-only feed focuses on your friends’ purchases, and the personal feed records your transaction history.

Users can use their Venmo account to interact socially by using features like likes, comments, emojis, Bitmoji, and Holler stickers. In this way, Venmo mimics a social network, which makes it super engaging and more than just an app for financial transactions.

A Smooth User Journey

Venmo has excelled in providing a seamless and uniform user experience within its app. Whether users arrive via paid advertisements, social media links, or promotional links, the core message is consistently and effectively communicated across all these channels, including within the App Store page.

To align with users’ expectations at every interaction point, Venmo has meticulously fine-tuned its App Store listing. In the past 6 months, it has made several updates to the screenshots, ensuring they harmonize with the key messages promoted on social media and through paid user acquisition.

In the first three screenshots featured on the App Store, which hold the greatest influence on conversion rate, Venmo places a strong emphasis on the simplicity of sending and receiving money, the advantages of earning cashback, and the benefits of using Venmo’s debit card.

These core messages are not only prominent in paid channels and social network posts but also form a central theme in influencer collaborations.

Venmo's User Acquisition Strategy

Instagram and Facebook

Venmo’s strategy, as reported by Apptica, primarily revolves around two key acquisition channels: Instagram and Facebook.

Currently, the app has 44 active creatives, encompassing both static images and videos. Notably, the best-performing ads, based on impression share and longevity (those that have been live for more than 3 months), emphasize:

- Cashback Benefits: Highlighting how users can earn up to $10.

- Promotion of New Features: Specifically, the introduction of Credit and Debit cards.

- Privacy Emphasis: Exploring users’ options to either share their payments or keep them private.

The visuals are a perfect match for the target audience, as they are vibrant, concise, and highly engaging.

Alongside paid user acquisition efforts on Instagram, Venmo is actively engaged in various promotional efforts, including partnerships with prominent influencers and celebrities such as @cordae (2.3M Followers) and @mariahcarey (12.1M Followers).

TikTok

While we didn’t observe Venmo running extensive ads on TikTok, they opted for a different approach by collaborating with a range of diverse TikTok influencers.

Their aim was to generate excitement around their referral program, where users can earn up to $25 for introducing new friends to the platform. Notable influencers involved in this initiative include @jonnym0rales (3.4M Followers), @dreaknowsbest (6.4M Followers), and @plastique_tiara (11.7M Followers).

x (Formerly Twitter)

Despite having over 607k Followers, Venmo has been inactive when it comes to user acquisition on X this year. Over the past couple of years, Venmo primarily used X as a platform for rewarding users through giveaways.

We’re giving out $10K just in time for the best season 🏈 Follow & drop your Venmo handle in the comments for a chance to win $20 or $50. #VenmoMe

— Venmo (@Venmo) August 24, 2022

Must follow @Venmo. No purch nec. Ends 8/24/22. US only, 18+. Venmo acct req’d. Rules: https://t.co/TH3YX7POWN pic.twitter.com/lLSozHdV0p

During the #VenmoMe campaign, Venmo dished out $100,000 in prizes. Considering their approximate revenue of $500 million in 2020, this $100,000 investment in the campaign proved to be a cost-effective strategy to boost their website traffic.

Venmo certainly has a multitude of strategies up its sleeve to drive its growth. One effective method is harnessing the power of word of mouth, especially beneficial for products like theirs.

In fact, marketing studies from various fields show that a whopping 92% of people value their friends’ recommendations more than ads when making decisions.

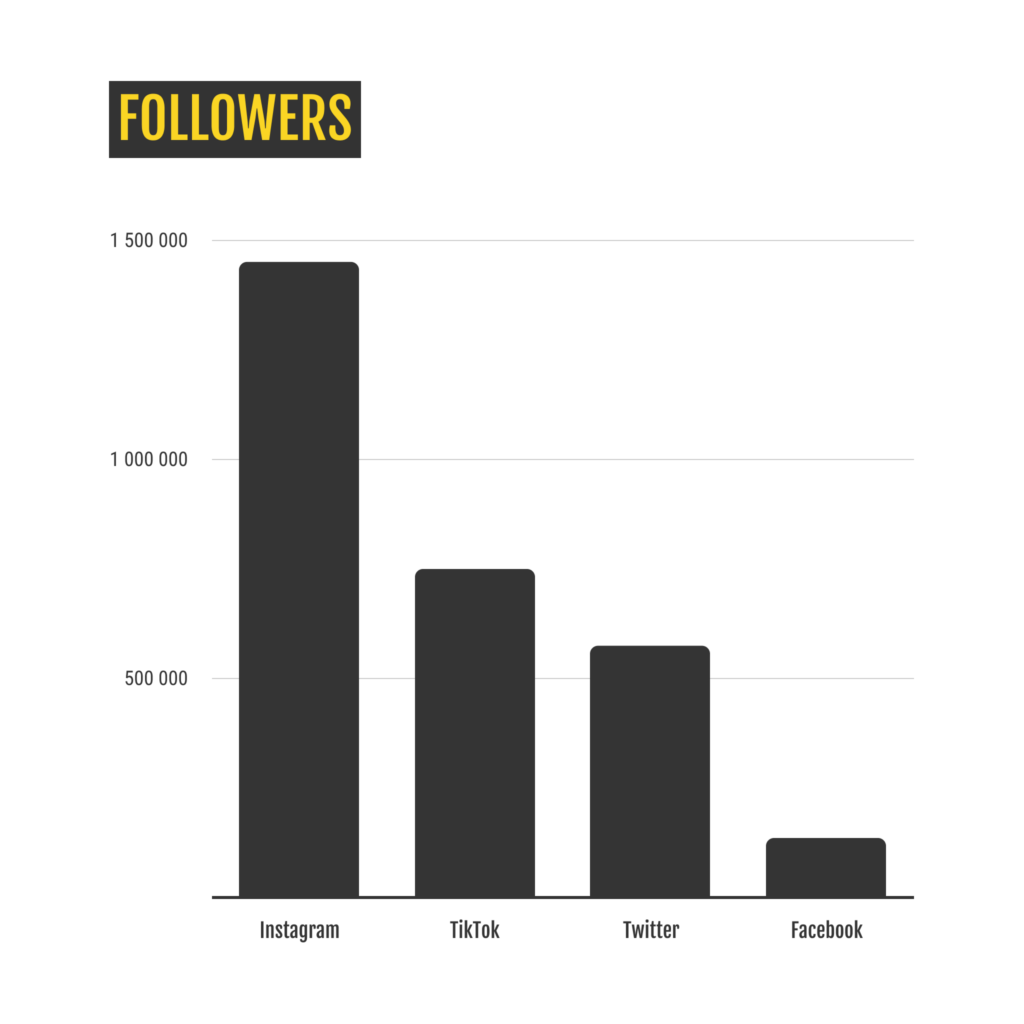

Venmo has masterfully leveraged this by fostering a loyal community and actively engaging with its audience on various major social media platforms. Notably, on Instagram, Venmo boasts 1.4 million followers, and on TikTok, it has garnered 763,000 followers.

Venmo's Monetization: Unraveling the Revenue Streams

How do free apps like Venmo generate revenue? Venmo employs a multifaceted business model to sustain its profitability.

Let’s explore the components of this business model:

- Merchant Fees: When users make payments to merchants through Venmo, the merchant is charged a fee. This is akin to how credit card companies charge merchants for processing credit card transactions.

- Venmo Debit Card: In 2018, Venmo introduced its debit card. Users utilizing this card contribute to Venmo’s revenue by generating interchange fees from merchants, a mechanism similar to traditional banks.

- Instant Bank Account Transfer Fees: While transferring funds from a Venmo account to a bank account typically takes 1-3 business days for free, Venmo offers an “Instant Transfer” option for users seeking quicker access to their funds, albeit for a small fee.

- Venmo Credit Card: Introduced in 2020, the Venmo credit card generates revenue through interest charges, any applicable annual fees, and interchange fees.

- Earning Interest on Stored Funds: Like other payment platforms, Venmo holds user funds in pooled bank accounts. The company earns interest on these funds before they are withdrawn or spent, contributing to its income.

- Partnerships and Promotions: Venmo has cultivated partnerships with various businesses, offering special promotions that serve as an additional source of revenue.

- Venmo for Business: Venmo provides a platform for businesses to accept payments through their service, charging a processing fee for these transactions.

In conclusion, while Venmo offers a seemingly simple service to its users, its revenue model is a complex tapestry of innovative financial solutions and partnerships. The next time you send a payment or split a bill using Venmo, remember the intricate web of revenue streams working behind the scenes and fueling this company.

Final Thoughts

We hope that this article has provided valuable insights into how you can adapt the Venmo growth strategy to suit your business model. Drawing from our extensive experience working with apps of various sizes and growth stages, we can assure you that these strategies are applicable across different categories.

Identifying which growth activities to prioritize – whether it’s branding, performance marketing, ASO, or any other aspect – represents the most crucial (albeit challenging) process that apps of all sizes must navigate.

If you’re interested in more articles where we delve into the success stories of apps in specific categories, or if you’re seeking a similar or even more comprehensive analysis for your own app, reach out to me at tatiana@appagent.com!