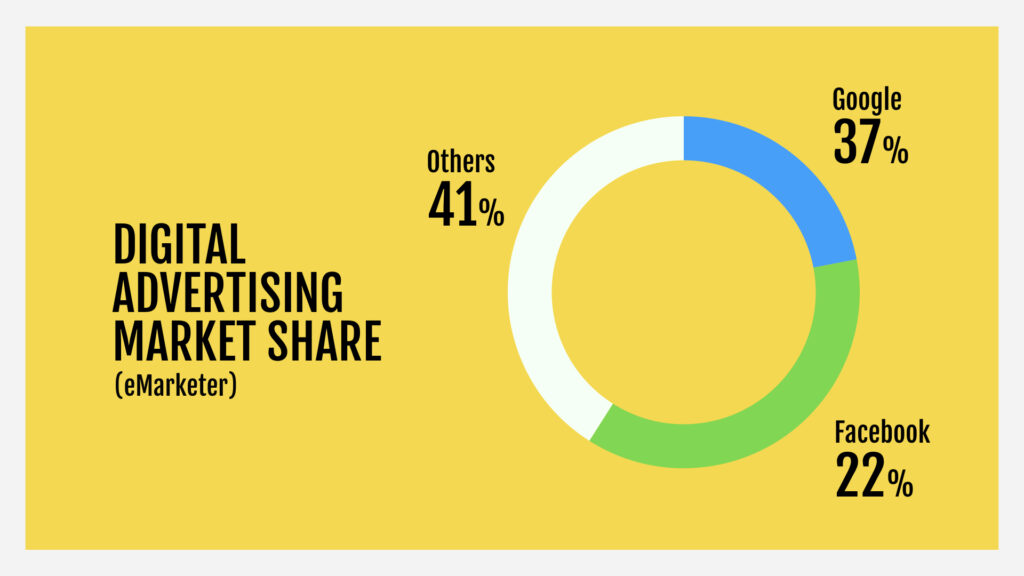

AdAge recently reported that the duopoly of Facebook and Google share almost 60% of the digital advertising market between them. Mobile advertising accounts for two-thirds of the entire advertising market worldwide – and continues to grow as we spend more time online.

What does it mean? The majority of media budgets are focused on two major channels – increasing competition and raising prices. To succeed online, you have to diversify your channels to fight the increasing costs and growing dependency on Facebook and Google. But, how do you select the right channels for acquiring new users for your app or game? What are the criteria you should focus on? And how do you effectively test them?

There’s no ‘one-size-fits-all’ rule, instead, specialists develop their strategies. To understand different professionals work, I invited three amazing UA experts from very different businesses to compare their approaches at the App Growth Summit Berlin stage. In this blog, you can learn the methods that work for them and hopefully pick up some tips on what might work for you. The mobile marketers I have selected are Lenette Yap from Wargaming Mobile, Christian von Hedemann from Clue (recently at Wolt) and Maria Brigida Deleonardis from Free2Move.

The most effective mobile user-acquisition channels

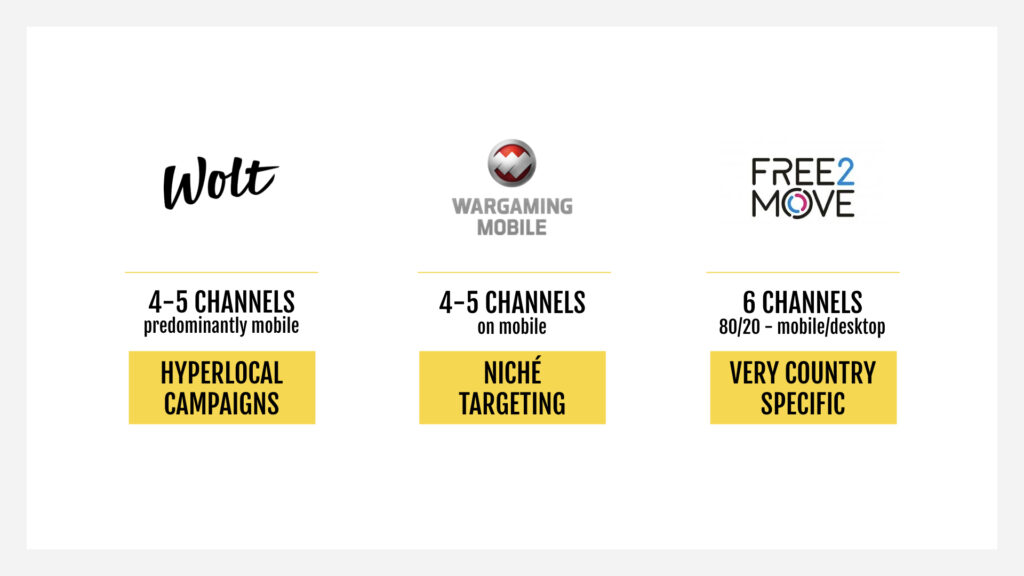

The UA teams at Clue, Wargaming Mobile and Free2Move have, on average, five acquisition managers who currently run campaigns on four to six channels. Predominantly they focus on Facebook, Instagram, Google Ads, and Apple Search Ads. Some target specific networks including Bing, Yahoo or Snapchat running in specific countries (for Free2Move), or video networks such as Ironsource or Unity Ads (for Wargaming). I believe that this surprisingly small portfolio of ad networks isn’t due to the lack of testing, but rather the weak performance of many tested channels. The reality is that only a handful of advertising networks can deliver the user-acquisition results demanded.

For food delivery service Wolt, where Christian von Hedemann has spent the previous two years, hyperlocal targeting is essential. To be successful, Wolt needs to display to users popular local restaurants in their neighborhood, but currently, not many networks offer geo-targeting at this granular level. However, the large ad networks (FB, Google, and SnapChat) offer zip-code level targeting along with radius targeting. This allows the advertiser to pinpoint exactly where their ads are shown, ensuring that no impressions are wasted on people that cannot use their product because they live outside of the delivery area.

According to Lenette of Berlin-based Wargaming, the authors of the global hit World of Tanks, finding the right users involves niché targeting. Their audience is very specific, mainly consisting of players in their 30s – with some even older – with an affinity for war themes and history (i,.e. famous tanks and warships in history). Their games, World of Warships Blitz and World of Tanks Blitz, employ tanks and warships in 7v7multiplayer combat game mode and focus on tactical gameplay elements. Video networks allow you to white- or black-list specific genres, publishers, or even games in which your ads are shown. By using this feature, Wargaming narrows down its targeted audience, focusing on sources that match the specific tastes of their players. Currently, Wargaming Mobile focuses on five core channels that perform consistently well, with more focus on social networks like Facebook/Google targeting niche audiences. Other partners are tested continuously (Note: If you’d like to know more about another social network as TikTok, here are a few reasons why to give it a try).

Free2Move, on the other hand, launches its mobility service city-by-city, for the aggregator app and operational car-sharing app. Today, they cover 15 locations in Europe and are currently testing the US market in Washington. Concentrating on six networks, they typically use an 80-20 share between mobile and desktop advertising. Maria recognizes that acquisition channels perform differently in each country. For example, Bing works better in France, Yahoo in the US, etc. Such insights demonstrate the importance of testing various ad networks and focusing on those that perform best for you – not blindly using a mixture of networks recommended by others.

The UA manager’s checklist for new channel testing

The specifics of the product and UA are naturally reflected in the selection of ad channels. All panelists agreed on the importance of Mobile Measurement Partner (MMP) integration, post-install optimization, and transparency when it comes to the traffic and placements. However, when it comes to Google UAC – which isn’t transparent at all – these requirements are put aside, as the network performs and delivers results (and that’s ultimately what matters). Wolt and Free2Move need geo-targeting, whereas Wargaming looks primarily for its audience fit/demographic targeting and smart algorithms to enable it to cherry-pick niché players.

In general, all UA managers agreed that they prefer self-service, where they have full control and can learn from the data. Selina Springvloet, head of marketing at Wargaming Mobile, mentioned during our screening call prior to the event in Berlin that once she relied on testing programmatic media buying through a managed service. Not only were the campaigns unsuccessful in achieving their performance targets, but due to the lack of transparency, lack of access to data and ability to iterate on their own, they weren’t able to learn anything from the investment made. “We will definitely follow-up on this test, but this time the approach has to be different. We need to commit more and be ready to invest time and effort into cracking the nut and demand transparency from the partners we work with,” Selina says, wrapping up her thoughts on the right approach to exploring programmatic channels.

Best practices for testing new UA ad networks

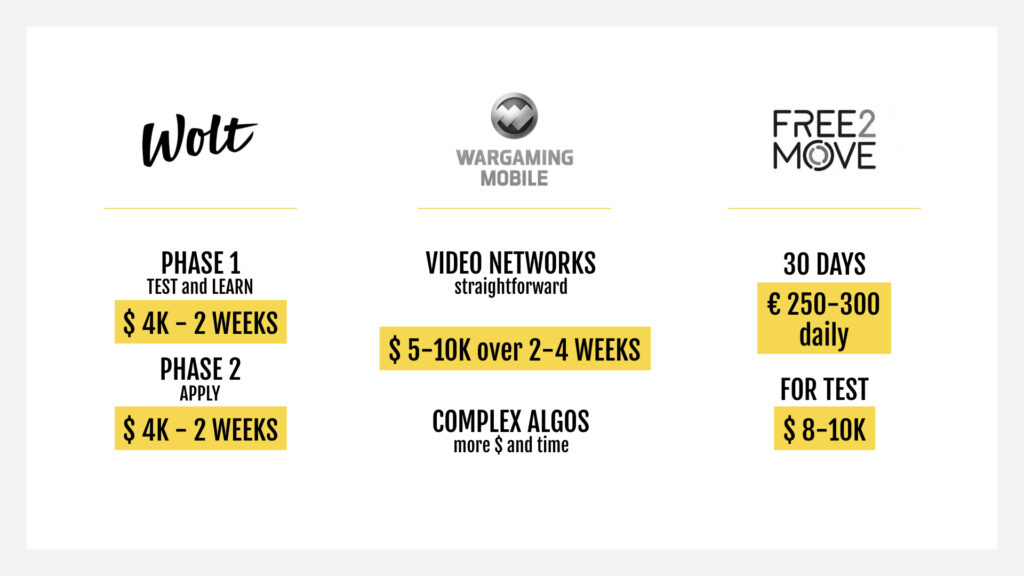

Both Christian (Wolt) and Maria (Free2Move) have a similar approach to the testing process, splitting it into testing and learning phases. What does this mean in practice? Firstly, they run a campaign for two to four weeks to gather data. It needs to be at least two weeks, so you can observe weekday fluctuations. Two weeks should also give you enough data to see if there is potential to optimize your campaign towards its target, e.g., cutting certain sub-publishers, honing in on the creative, target, etc. The next two weeks are used to try and get as close to the goal as possible. However, any network requires work. Make sure you have the resources to dedicate to a test to give it a fair chance. Don’t expect a new channel or network to perform immediately, but use the test to gauge the potential of the channel to become a valuable acquisition source in the future.

Lenette (Wargaming Mobile) highlighted an important point. In prioritizing which networks to test, look into the amount of time you can dedicate for analyzing campaign performance. It takes time to investigate the quality of the traffic, compare metrics with existing networks, check for fraud and optimize from scratch. Networks with deeper targeting options and complicated buying algorithms like Snapchat, Facebook, Google require more attention and testing frameworks, whereas simple video networks can be assessed more easily. However, successfully testing video networks requires a significant budget due to the number of publishers available.

As a rule of thumb, you should be able to collect enough data over one month with a budget of USD 5-10,000. But then there are specific channels, like content ad networks Taboola or Outbrain, which, according to Sandra Wu from Blinkist, could take up to six months – and $50,000 – to properly test and optimize.

As the industry evolves at a rapid pace, you shouldn’t forget to retest your chosen channels every six or 12 months. New features, better targeting capabilities, or inventory might result in dramatically different performance than you may have experienced in previous tests. This is especially true for the new social platforms like Pinterest, Tiktok or Spotify which evolve at a rapid pace, but you might also notice new formats on YouTube recently like Discovery Ads or Gallery Ads that could alter ad performance of this rather classic ad channel which is part of Google’s Universal App Campaign.

I would recommend that you check early on if the network you want to test is available for a business entity in your specific country. At AppAgent, we experienced issues when one of our clients without a UK subsidiary struggled to advertise on both Pinterest and Snapchat in that country. Thankfully, we fixed the problem, but it took a couple of weeks to resolve.

Another tip comes from Lenette who shared in the Mobile Growth Nightmares podcast her story relating to ad fraud on one network (more on ad frauds in this article). When experimenting with new/unknown partners, it is crucial to analyze the quality of the traffic and look for post-install signals that could indicate fraudulent activity. All panelists rely on anti-fraud modules of their MMPs, but there are also specialists available in the market like Scalarr.io which can integrate with Appsflyer, Adjust, Singular, Kochava and several other MMPs and marketing analytic platforms to detect potentially fraudulent behavior (Note: Here is a comparison of four major mobile attribution partners).

Last but not least, all panelists mentioned they regularly ask peers for tips and best practice advice. UA Society, Mobile Dev Memo Slack channel, Mobile Marketing Experts FB group or classic events offer fantastic opportunities to engage in conversation and gain access to information that could help you to avoid a lot of potential headaches.

What KPIs to follow when testing new ad networks

When it comes to key performance indicators (KPIs), they differ quite a lot for all three businesses.

Free2Move tracks ‘Cost-per-Registration’ as the first proxy to the future ‘First Booking’ and subsequently ‘Cost-per-Booking’. This is quite similar to Wolt, but the specifics of limited delivery areas also led them to develop their own ‘Registration rate inside/outside of delivery area’ metric. If UA managers generate traffic outside of the covered metropolitan area, it’s basically wasted budget and therefore it’s important to look at the campaigns through this lens. The main metric is, as for most other companies, Return On Ad Spend (ROAS) which uses predictive modeling to determine the ultimate user’s LTV.

In gaming, the typical metrics followed are ads Click Through Rate (CTR) and Install Rate (CVR) as the first checks for traffic quality. More in-depth in-game metrics are then evaluated at the cohort level, i.e. retention, conversion to payers, return on ad spend (ROAS) and predicted lifetime value (LTV) on D1/D3/D7/D30, etc.

These KPIs also demonstrate that user acquisition specialists now focus on parsing out the best events to quickly evaluate the quality of the traffic. These events are then sent to ad networks to provide the best proxy for finding valuable users. With Facebook’s App Event Optimization, Value Optimization, and Google’s AC, the work of marketers has shifted from manual campaign optimization to the precise identification of optimization events and the development of the creative strategy.

How far would you go outside of performance channels?

It’s becoming more common for mobile marketers to go beyond the ‘known’ territories and run campaigns on TV, outdoor, or other classic ‘above the line’ media. Blinkist is sponsoring podcasts, Seriously built its whole ‘Best Fiends’ marketing strategy around influencers, and Innogames enjoyed success with pre-installs. The synergies between traditional media and performance marketing are becoming more obvious as methodologies around how to attribute traffic are improving. They give UA managers the power to incorporate previously considered non-performance channels into measurable – and therefore performance-driven – campaigns. But, that’s a whole new topic which we might discuss next time. See you at App Growth Summit in Berlin in 2020!