When it comes to mobile growth, there’s a secret recipe that blends investment, customer acquisition, and making a profit. This article is all about that secret sauce.

We’ll be diving into the concept of Customer Acquisition Cost (CAC) Payback – a bit of a mouthful, but a big deal in the mobile industry.

Let’s unpack what CAC Payback is, how it shapes mobile growth, and some smart ways to make it work for business.

In this article, you will learn:

- The definition of key metrics like CAC and LTV.

- How to calculate CAC Payback Period.

- The concept of Growth Flywheels and their relationship to CAC Payback.

What is CAC Payback?

Unit Economics

Before we define what CAC Payback is, we first must take a step back and define unit economics.

You can think of unit economics as the financial heartbeat of your business. It’s all about breaking down the cost and revenue associated with a single customer (or unit) who purchases your product or service.

CAC vs. LTV

The most well-known KPIs in unit economics are CAC and Lifetime Value (LTV).

CAC is the amount of money you need to spend to acquire one new customer. Think of it as the investment you make to bring someone new into your business ecosystem. CAC includes factors like marketing costs, advertising expenses, and even the salaries of your sales team.

LTV, on the other hand, is the estimated total revenue that a customer will generate for your business throughout the entire relationship. This includes repeat purchases, upsells, and any subscription renewals. Understanding LTV helps you visualize the long-term value that each customer brings to your bottom line.

You want your LTV to be significantly higher than your CAC. Ideally, your customers should bring in more money over their lifetime than you spent to acquire them. This means that you’re creating a sustainable and profitable business model.

But the story doesn’t end there.

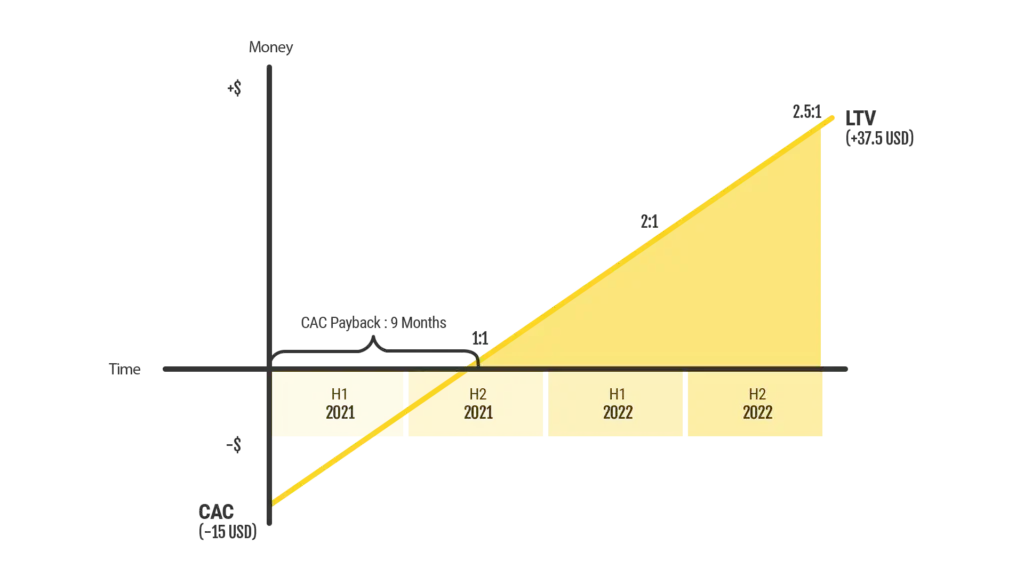

The CAC Payback Period basically indicates the timing of your financial gratification. A shorter payback period is generally better; it suggests that you’re recouping your investment quicker, and you’re moving closer to pure profit. The CAC Payback Period typically expresses in months how long it will take you to recoup your CAC.

Why is the CAC Payback Period Important for Growth?

Historically, as marketers, we have been extremely disconnected from financial concepts like unit economics. We’ve been thinking in silos, always visualizing linearly (in funnels) and separately from profitability and company growth.

But we must understand that acquisition plays a key role in the quality of the customers we bring to a business. If we give businesses the right inputs, the output will be profitability. That’s the key here.

CAC Payback as a Tool for Measuring Speed to Profitability

Another important piece of the puzzle is the speed to profitability, and that’s exactly what the CAC Payback Period is for.

Outpacing our competitors with a shorter CAC Payback Period translates to a faster Growth Flywheel. Over time, the compounding effect of this speed can significantly alter the trajectory of our growth journey.

What is a Growth Flywheel and How Does it Relate to the CAC Payback Period?

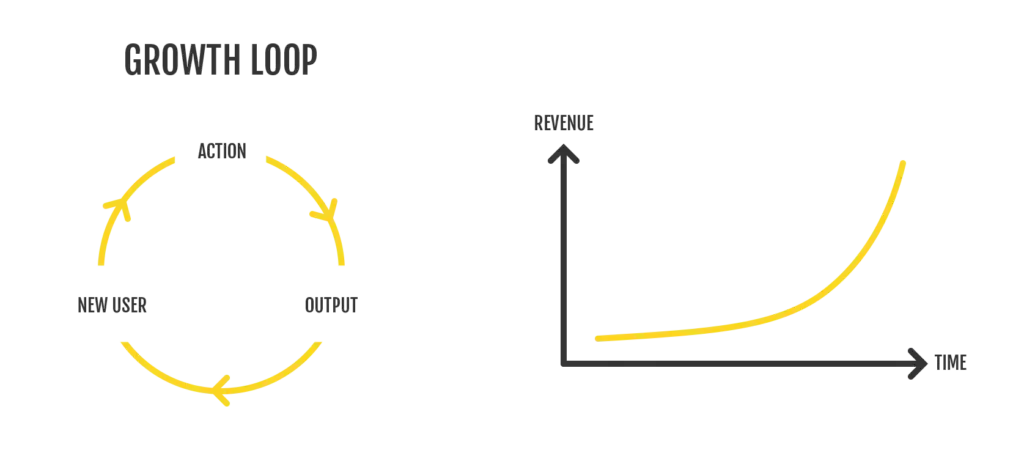

Picture a flywheel – a large wheel that takes effort to set it in motion, but once it catches momentum, it continues to spin with reduced effort.

In the context of marketing, the growth flywheel emphasizes the creation of a self-reinforcing cycle, and this can be achieved in various ways.

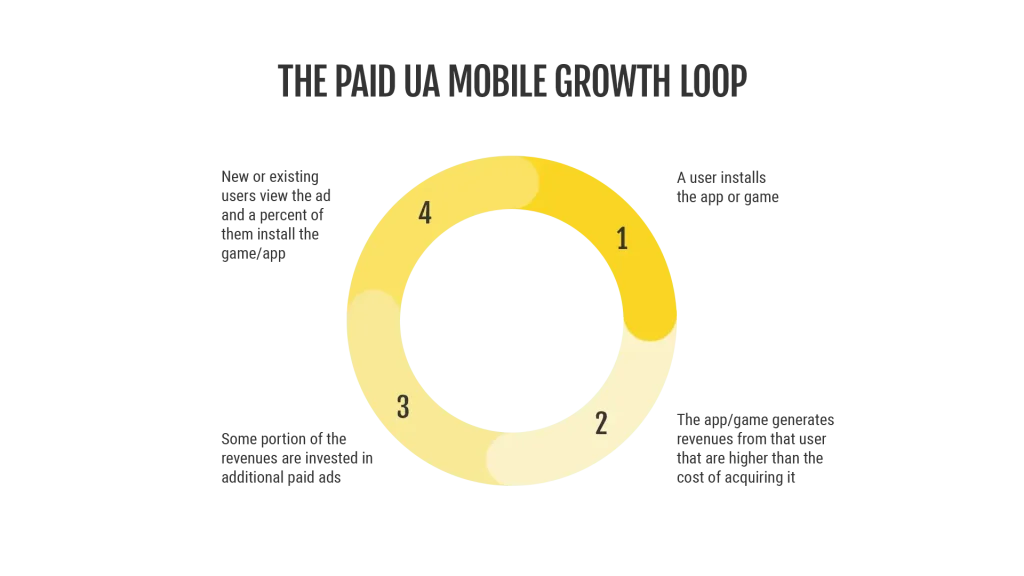

In the following example, I will explain a paid user acquisition loop serves as the foundation for this flywheel effect.

Consider this hypothetical situation: Imagine you spend $1 to acquire a customer through Facebook (that’s your CAC), and when that customer uses your product, you earn $3 (that’s your LTV). In this case, every customer you bring in helps you pay for 2 more customers. This creates a kind of chain reaction that gathers momentum and leads to exponential results.

But in reality, there is a crucial component missing from this scenario: TIME!

This is why the CAC Payback Period metric is so important – this KPI translates to momentum and the potential for exponential growth.

How to Calculate the CAC Payback Period

To put things into perspective, let’s look at a practical example with two fictitious companies:

In the first company (let’s call it Company 1), the cost to acquire a customer (CAC) is $15, and the overall earnings from a customer throughout their entire time with the company (LTV) is $37.5.

The second company (let’s call it Company 2) also has an LTV of $37.5, but their CAC is cheaper, at $10.

Now, if you were to decide where to invest your money, which of these two companies would you lean towards?

Naturally, if we look at things in a linear manner, Company 2 seems quite appealing based on this information. For each dollar they spend, they reel in more customers. For instance, if Company 2 invests $10,000 in acquiring customers, they’ll attract 50% more customers compared to Company 1’s $10,000 investment.

It sounds like a pretty sweet deal, right?

But there is a catch: you’re not aware of how much time it takes each company to actually earn back that money. And, as we touched on earlier, the pace and momentum of this process are pretty crucial.

Let’s break down the CAC Payback Period calculation before we re-evaluate these companies.

The CAC Payback Period Formula

To get the CAC Payback Period, you simply divide your Customer Acquisition Cost by the average profit you make from each user every month (CAC/ Net profit per user per month).

When you crunch the numbers using the CAC Payback Period formula, you’ll get the number of months it takes to earn back the money you spent on acquiring customers.

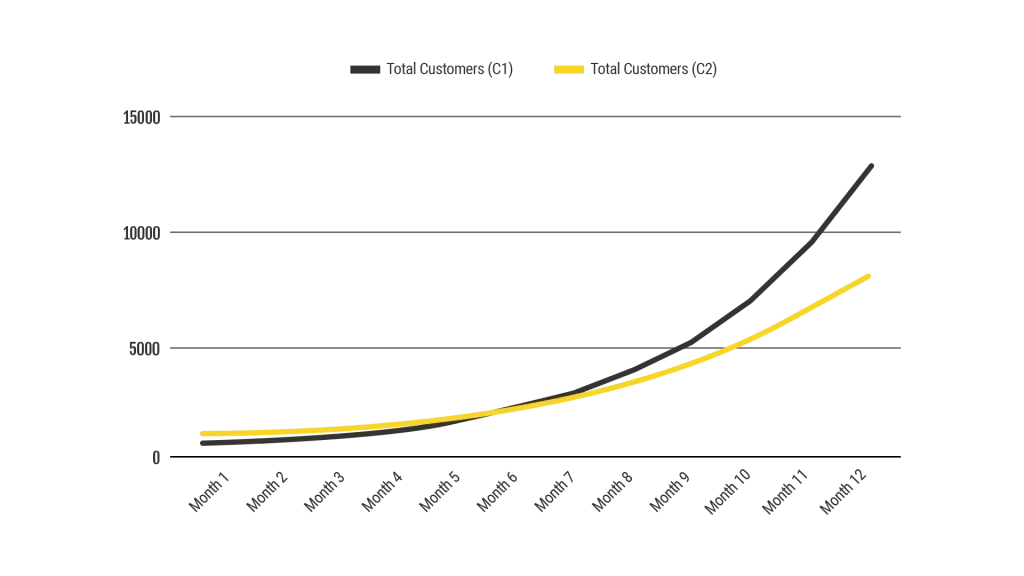

As we can see in the table, Company 1 recoups its investment almost twice as fast as Company 2. This advantage allows Company 1 to begin spending on new customers sooner, who, in turn, recoup their spending faster as well.

This strategy’s compounding effect will eventually propel Company 1 ahead of Company 2, leading to a larger customer base and greater profits in the long run.

As we can see, in the theoretical scenario where both companies reinvest their profits into acquiring users, it only takes 7 months for Company 1 to outpace Company 2. From that point onward, Company 1 experiences exponential growth. This is the power of having a faster Flywheel.

Now that we understand the value of having a shorter CAC Payback Period, let’s understand how to optimize it.

1. Prioritize Customer Retention

Your primary focus should be on retention. Having a product that keeps users coming back is crucial for sustained growth.

Avoid the leaky bucket problem, and invest in understanding your customers’ needs, pain points, and motivations. This will enable you to create an engaging and satisfying product.

2. Segmentation and Personalization

Not all customers are the same, and treating them as such can lead to missed opportunities. Segment your customer base depending on their behaviors, preferences, and potential value to your business.

You should then tailor your marketing strategy and offerings to address their specific needs and encourage higher spending.

3. Monetization Strategies

Increase the value you collect back from your customers via various monetization strategies. This could include upselling higher-priced products or services, offering premium features, conducting pricing tests, solving additional use cases, or introducing new services that align with your product.

4. Iterative Funnel Optimization

While customer acquisition costs are no longer the sole focus, it’s still essential to optimize the customer acquisition process.

Continuously analyze and improve the efficiency of your user acquisition efforts. A well-tuned acquisition funnel can bring in more valuable customers and shorten the CAC Payback Period.

5. Focus on Profitability, not Scale or Vanity Metrics

As enticing as rapid growth may sound, prioritizing profitability is essential. Continuously monitor the current and projected value of your customers, ensuring that it exceeds or will exceed the cost of acquisition. It’s better to have a smaller yet profitable customer base than to have a large, unprofitable one.

Key Takeaways

Have a high-level understanding of how your unit economics work: Having a clear understanding of how much money you can make per customer and when you will make that money is indispensable for business planning and growth budget allocation.

Speed to profitability is important: Making returns on your investment faster than your competitors is a great advantage, as it allows you to invest those returns in more acquisition and generate a loop with exponential results.

Think in flywheels, not funnels: Optimizing your funnel is great, generating a self-sustaining flywheel is better. Thinking in linear terms will only get you so far, but thinking in loops, compounding effects, and exponential growth can unlock very powerful results.

- Acquisition ≠ Growth: Keep in mind that growth is not solely about customer acquisition and CAC. For genuine growth, profitability plays a crucial role, and it’s not solely connected to LTV.

Keep a close eye on your LTV and use predicted LTV, LTV : CAC ratio + Payback Period to evaluate your growth initiatives.

Below we’ve provided a couple of tools that we’ve developed to assist you in gaining a clearer understanding of your LTV and how it connects with your business:

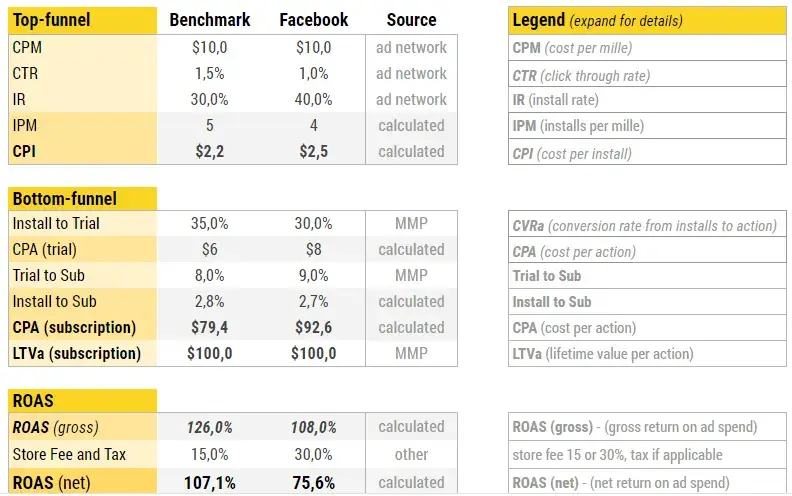

The User Acquisition Viability Calculator

The UA Viability Calculator is a table representing the whole UA funnel, from the first impression to the final ROAS. After we input existing data points and assumptions, a handful of simple formulas will transfer these to a “potential ROAS” figure, which we can then analyze and examine a variety of “what if” scenarios.

Download the calculator HERE.

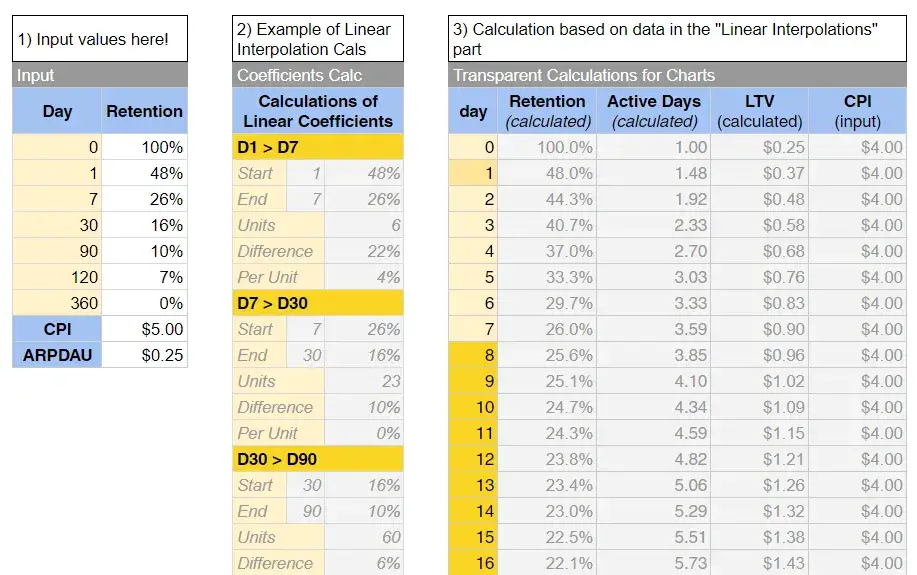

The Retention to LTV Calculator

Input your retention / ARPDAU points to calculate your LTV and perform a visual analysis of the resulting LTV curve. Model what-if scenarios for your ROAS for new channels or cohorts.

Download the calculator HERE.

If you’ll need any help with this topic, or feel that you’d require a more advanced Growth Model to understand your scalability potential, please, drop me a message at hi@appagent.com.

What is Customer Acquisition Cost (CAC)?

CAC is the amount of money you need to spend to acquire one new customer.

What is the CAC Payback Period Metric?

The CAC Payback Period typically expresses in months how long it will take you to recoup your CAC.

What is the CAC Payback Period formula?

CAC / net profit per user per month

What is a good CAC Payback Period?

A shorter payback period is generally better; it suggests that you’re recouping your investment quicker, and you’re moving closer to pure profit.