LTo learn more about industry insights and best practices, sign up for the AppAgent newsletter here.

4 calculations types for the customer acquisition cost index

If your boss asks you how much you are spending for one paying customer, would you know the number?

Maybe you already calculate your Cost Per Action (CPA) or Cost Per Install (CPI) and have an attractive spreadsheet to send to your boss. Do you know what your Customer Acquisition Cost (CAC) is? Have you ever calculated ALL of the costs involved in attracting a new paying customer to your app or game?

By the end of this in-depth guide, specifically tailored for mobile marketers and gaming companies, you will have learned:

✔️ What CAC is and why it’s a critical metric for mobile app profitability

✔️ Why you need CAC for effective mobile user acquisition strategies

✔️ The advantages of knowing your mobile app’s CAC

✔️ How to calculate CAC using different methods

✔️ What to do with your CAC data next to optimize your marketing efforts

What is Customer Acquisition Cost?

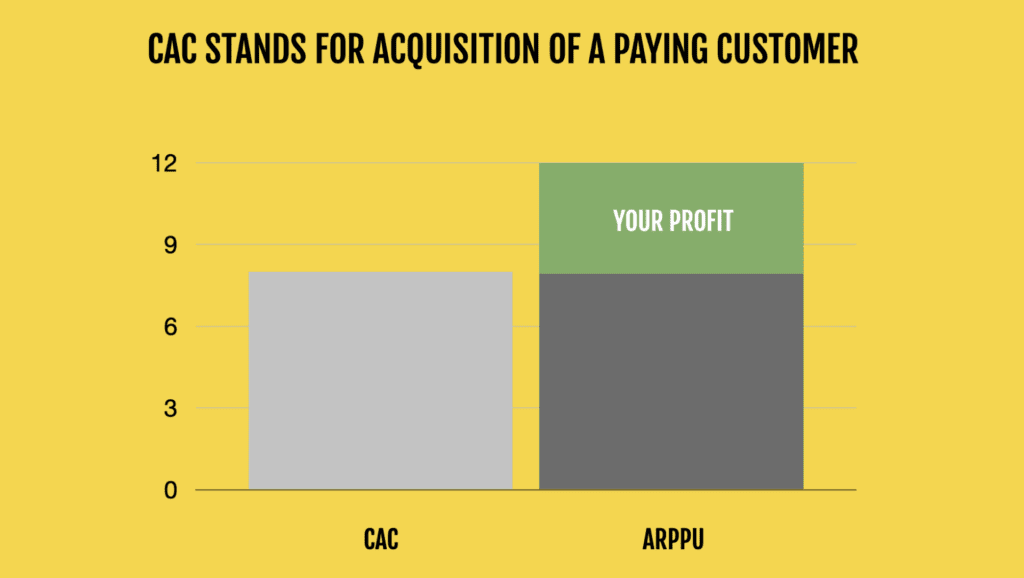

CAC stands for Customer Acquisition Cost. While this index may be familiar to mobile app marketers, everyone in your company – from product managers to finance teams – needs to know what your CAC is. Here’s why it’s particularly vital in the competitive mobile gaming and app landscape.

Most marketers are confident using CPI (Cost Per Install). However, unlike CPI, CAC relates to a specific person who spends money. A CAC calculation is useful when your primary goal is to increase the number of paying users. In contrast, your CPI is a better metric if your target is the overall growth of an app’s user base. For gaming apps, where in-app purchases and subscriptions are common revenue streams, distinguishing between an install and a paying customer is crucial for sustainable growth.

If you want to understand how to read user acquisition data and optimize your top-of-funnel performance, read our post that explains other key metrics such as CTR, CVR, and IPM.

Now back to CAC. The fundamental purpose of this metric is to calculate the full cost of acquiring a new customer over a defined period. This includes not just ad spend, but all associated marketing and sales costs that directly contribute to bringing in a new customer.

Put simply, the lower the CAC for your mobile app, the better, because your profit margin grows.

If your mobile app’s CAC is low, then your user acquisition campaign is likely profitable. In this circumstance, it’s logical to let it run.

However, in the real world, nothing is that simple.

Be sure to consider payback time in your CAC calculations because with advertising you pay the costs now, but receive the revenue later. In extreme circumstances, a company can suffer from severe cash flow constraints, even while running profitable LTV campaigns. In some cases, this can threaten the entire business, especially for mobile games with long monetization cycles.

You can measure the CAC index in isolation, a process that has some value. However, if you compare it with other metrics, you get a much better – and more accurate – picture of how your mobile marketing campaigns are performing.

Let’s explore how you assess your CAC in combination with your LTV (Lifetime Value of your customer). If you’re interested in this topic, read more on how to set up a solid LTV strategy, or download our Retention to LTV Calculator / Predictor.

Your marketing efforts should aim to find channels with a high LTV:CAC ratio and are scalable. It doesn’t make sense to spend all of your time on user acquisition channels that only deliver small numbers of high-value customers if they can’t be scaled up.

The CAC formula can be a little tricky because the definition of a “customer” differs depending on the type of business and its monetization model. The customer can be a person who buys a subscription, who pays for more lives, or who buys a new pair of shoes.

In the ad business, a customer might be simpler to define: the customer could be a person to whom reward ads start to be shown when reaching a particular level. For subscription apps, it’s the first subscription bought.

Examples of customer definitions from AppAgent’s client portfolio include:

- Kiwi.com – anyone who purchases their first flight ticket, hotel, or any other service.

- Joom – anyone who orders their first pair of shoes or any other product from an e-shop.

- Small Giant Games – first in-app purchase made.

- Promotheus – first ad viewed.

- Studycat – first subscription bought.

It can be complicated to calculate your CAC accurately. The calculation depends on which department in your company is monitoring the numbers and their specific objectives.

A list of the most commonly used CAC metrics

Here are the primary ways mobile app and game companies typically calculate CAC:

- Paid CAC

- Formula: Paid CAC = Marketing Spend / Paid Customers

- Purpose: This data informs whether a company can scale up its paid user-acquisition budget and make a profit. It’s essential for evaluating the efficiency of your paid advertising campaigns on platforms like Google Ads, Facebook, TikTok, and other ad networks.

- Blended CAC

- Formula: Blended CAC = Total Marketing Spend / (Paid Customers + Organic Customers)

- Purpose: This provides a broader view of your overall user acquisition efficiency. However, one disadvantage of blended CAC is that it can obscure the true profitability of your individual paid campaigns. Organic users also cover non-direct marketing efforts like ASO, PR, or word-of-mouth.

- Very Advanced Paid CAC:

- Formula: Very Advanced Paid CAC = (Marketing Spend + Ad Production Costs + Cost of Support Software + UA Managers Salaries + ASO Costs) / (Customers Acquired via Paid Channels + Customers Acquired via ASO)

- Purpose: This complex calculation offers the most comprehensive view of your acquisition costs, factoring in overheads directly related to user acquisition. While we don’t use this complex calculation often due to its data intensity, we provide it for awareness and inspiration as a holistic measure.

- Note on ASO costs: After every App Store Optimization, more organic users often come, which means lowering the effective acquisition cost per user over time.

- Company CAC:

- Formula: Company CAC = Total Company Cost in the Period / New Customers in the Period

- Purpose: This is a high-level, macro view. If this number is lower than cLTV (customer LTV) in the long-term, then your entire company is likely to make a profit. This is less about individual campaign performance and more about overall business viability.

Caveats about using the CAC metric

Experienced growth hackers and mobile UA managers know how to calculate CAC on a channel-by-channel basis, ideally for each campaign. As we’ve advised before, be sure to add the costs of referral fees, discounts, credits, and any other user acquisition costs to your calculation for accuracy.

Before you start calculating your first CAC, especially for your mobile game or app, be aware of a few critical caveats about using this metric:

- Payback Time Discrepancy: A company may have invested heavily in marketing for a new region or a new game launch, and the full results (revenue from those customers) won’t be received for some time. However, this payback time isn’t typically included in immediate CAC calculations. In this circumstance, you have to cover the costs now but receive the revenue later. A lack of cash flow caused this way can sometimes kill an otherwise healthy business, even if the LTV:CAC ratio looks good on paper.

- Revenue Model Changes: This caveat is particularly relevant for businesses that permanently alter their revenue schema, such as introducing new subscription tiers or changing in-app purchase prices. Price changes will impact your LTV, meaning that the old CAC might not be comparable to the new one. Always recalculate and reassess your CAC relative to your current monetization strategy.

- Partial View for High-Value Customers: CAC often provides an average. However, in many instances, particularly for mobile games, some customers have a much higher value than others (“whales” in games, renewing subscribers, etc.). The CAC to acquire a first-time customer is a good indicator, but it doesn’t fully reflect whether that payer will go on and spend a lot in the long-term. Consider segmenting your CAC by customer value tiers to get a more nuanced understanding.

CAC payback defines your cash flow… AND BUSINESS VIABILITY FOR MOBILE GAMES

Changing consumer behaviors as social norms revert to pre-COVID patterns and time spent with digital products subsides influence your CAC more than you can imagine. The aspect of when your customers pay for the app or in-game purchases can have massive implications on the ability to scale efficiently.

The cool down of the VC market and upcoming recession is connected to adversity against long-term bets towards future – and unstable – income. Investors are increasingly looking for cash efficiency and robust predictions based on fresh data reflecting changes in society and user behavior.

Companies with slow CAC payback require significant financial capital to scale. Many venture-funded startups begin their journey like that, but it’s vital for mobile app and game developers to measure the time aspect of CAC and work towards shortening it. This is where

Paywall Optimization Strategies become incredibly important – explore our blog post on Mobile App Onboarding: 5 Paywall Optimization Strategies or download our Cheat Sheet: 5 Paywall Optimization Tests.

If you are responsible for financial performance of your operations, I recommend you to read more on this topic and review a case studies of Netflix, Duolingo and Blue Apron.

Sources used for the article:

Customer Acquisition Cost: The One Metric That Can Determine Your Company’s Fate

The Importance of CAC Payback in Today’s Market Environment

Continue Reading:

Would you like to dig deeper into Customer Acquisition Cost? Here are a few great articles we recommend that you read:

- How does LTV / CAC fit into a growth strategy?

- Customer Acquisition Cost and Lifetime Value (CAC & LTV) presentation

- Mobile App Onboarding 4 Examples of Successful New User Flows (Great for understanding how initial user experience impacts retention and LTV)

- The principles of mobile ad attribution, analytics and tracking (Essential for accurate CAC calculation)

- Mobile Ad Monetization Masterclass: Waterfalls (For understanding the revenue side, impacting ARPPU and LTV)

*Optimizing campaign spend with the Blended Same-Month Return metric

How do you calculate blended cac?

Marketing spend/(paid customers + organic customers)

Organic users cover also non-direct marketing.

How do you calculate company cac?

Total cost for the whole company in the period / new customers in the period